Oracle's Fatal A.I. Constraint

Oracle is obsolete, perhaps the biggest short sale in a generation, we are going to prove it to you here

OK, we said it, Oracle is obsolete and we are giving you a front row seat for an inevitable valuation collapse, nobody currently sees, but most importantly, for you the tech follower, you the short seller, is trackable and begins to show itself during the next 18 months.

This is not investment advice - we are providing a glimpse into what is happening in the field - in real deals and disruption - demonstrating Oracle, and a dozen companies like Palantir, dependent on the current tech stacks are over-valued by a factor of 10.

That may be why a growing number of hedge fund guys subscribe to this newsletter - and sit in on Fractal product demonstrations.

How did Oracle become Oracle?

We were at the birth of a little company called Relational Technology Inc., or something like that in the 1980s.

It’s founder, Larry Ellison ran around the country with a 35 mm slide carousel (if you are under 50, Google it) telling VP’s of IT (that is what they called a CIO then) - telling them his database - Oracle, ran the same instruction set on their DEC VAX machines and IBM mainframes.

It was complete bullshit, as Oracle had two different products, but it didn’t matter much because relational database (RDBMS) was becoming a thing, mainframes were getting much faster and nobody cared about the overhead.

Ellison was selling a story - and that always works in software - until proof of hidden disruption seeps out and undermines the story - which is happening in the field now - unseen or ignored by the tech press and analysts.

We are publishing it here on this Substack - so subscribe because things are getting very compelling - with frequent reports coming your way.

The tech landscape in 1983 was driven by a company called Cullinane Software, later Cullinet, and ADR and a few others with early database management software.

IBM had this ghastly database called IMS - purpose-built to suck up more mainframe - so IBM loved it, customers, not so much.

The constraint in those days was people-intensive tech support for modifying the database.

Cullinet had a product called IDMS which used network pointers - hard coded little gremlins in the data and if you changed something, you had to rebuild an entire structure.

RDBMS (relational database) software - Oracle in particular - was far easier to manipulate but more of a storage and compute hog - as everything had to be lined up in rows and columns causing lots of data duplication.

So RTI at the time, took off, changed its name to Oracle - and Larry Ellison bought much of Hawaii.

That was then, this is now.

Oracle was built for HR, billing, common transactional systems using 1980s technology and for 40 years Oracle ignored advances in modern chip design - as all software companies did.

The overwhelming amount of data created today is not for CRM, HR and billing systems - rather from meters, sensors, cameras and devices - called IoT, Oracle is not a tech fit for that market.

So, provable today, super high volume, IoT data, needing collection, storing, decisioning instantaneously - is completely out of Oracle’s reach.

Oracle has close to total market penetration for the old stuff - HR, Billing, CRM but cannot compete in the new high volume, super speed decisioning applications.

Oracle’s huge market share exists - only because they are pretty much the last database standing from the 80s, and there is no newer technology to replace Oracle databases.

Oracle isn’t great at these transactional applications - because there is no IT god mandating all data is optimally stored in a relational (row and column) structure.

All kinds of data today is absolutely NOT going into an RDBMS - much of the IoT data - for instance, which is, by the way, the overwhelming amount of data on the planet.

Much of the A.I. data is not a fit for Oracle either - because much of the A.I. stuff is column based, needs to run at speeds that cripple an Oracle database - so Oracle must survive on current customers and getting into new businesses, like cloud computing.

Remember, there is no cloud.

Cloud computing is simply using someone else’s computer to run yesterday’s centralized compute technology.

Oracle is big in the cloud.

Cloud companies are showing continually lower valuations - because cloud computing is the Walmart of computing - lots of transactions at ever falling prices and tiny margins with undifferentiated services.

Ellison, probably the most brilliant marketer in the history of software - we are huge Larry Ellison fans here - is positioning Oracle as the next big thing in A.I. and A.I. development.

This week his stock valuation was reported to grow enough to buy the rest of Hawaii - because he announced a deal with OpenAI for $300 billion - running their stuff in his cloud.

Well, not so fast.

Some pretty smart people chimed in - making key points about why this is what in software is called vaporware - or akin to it.

Here are a couple of comments published in Wall Street Journal:

“To put Oracle’s $300 billion cloud deal with OpenAI in context, consider that the contract will require 4.5 gigawatts of power capacity, roughly comparable to the electricity produced by more than two Hoover Dams or four million homes.

The financial details are equally jarring.”

“OpenAI is a money-losing startup that disclosed in June it was generating roughly $10 billion in annual revenue—less than one-fifth of the $60 billion it will have to pay on average every year,” the WSJ reports.

“Oracle is concentrating a large chunk of its future revenue on one customer—and will likely have to take on debt to buy the AI chips needed to power the data centers.”

Remember the note above that Ellison told the 1980s market Oracle could run the same instruction set on a DEC VAX and an IBM mainframe?

Sort of the same thing here - this is an announcement - that any critical thinker can predict will never fully materialize - but it sounds good at a time of mindless market froth.

Only stock analysts, tech reporters and investors chasing unicorns would buy this story - and its subsequent Oracle valuation - without doing the math below the surface.

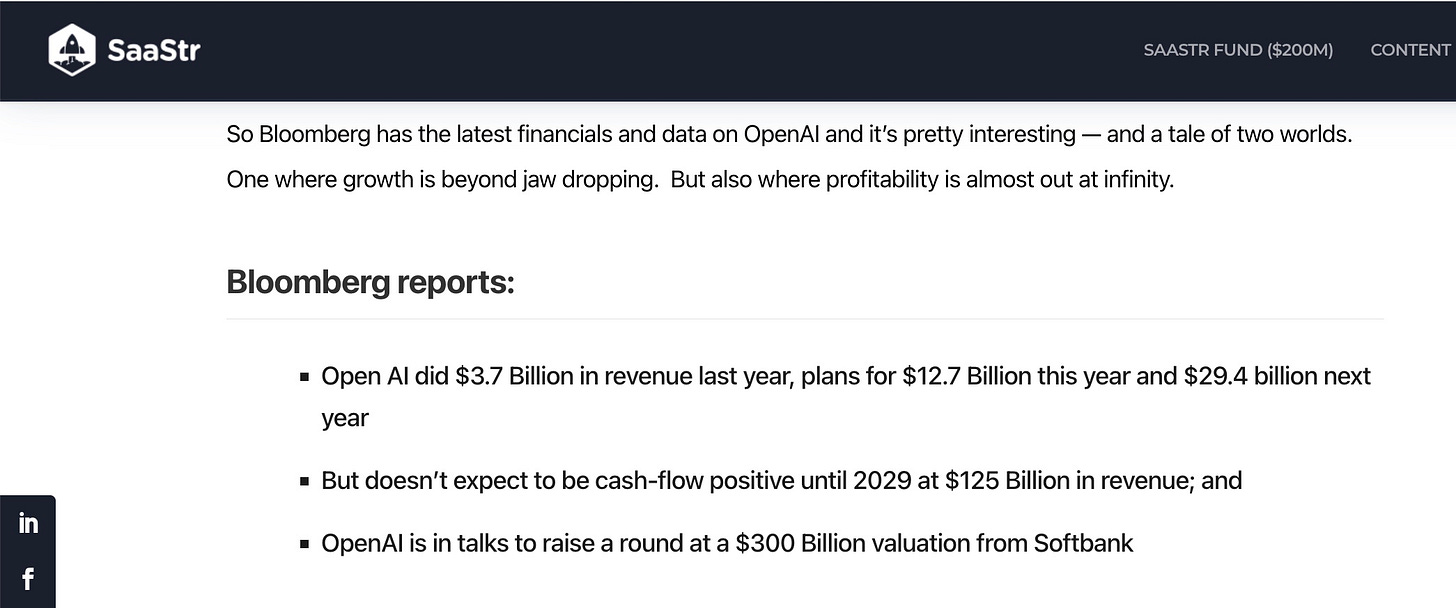

Since, as the article notes, Ellison is betting everything on a single customer, let’s look at OpenAI - that single customer:

We encourage you to Google around your own sources, but Bloomberg is pretty authoritative.

You will find article after article that A.I. is not making money for anyone.

Article after article reports 90% or more of A.I. projects are failing - so maybe it’s time to cut the cards.

We are not saying there is no coming disruption from A.I., we are just telling you it isn’t coming from ChatGPT, building horrendously large LLMs (large language models) at the very time even NVIDIA - who does make money - is saying the world is all small language models, running distributed, which ain’t Oracle.

As major Ellison fans, for 30 something years, we enjoy what soon may be the short of a lifetime - and it is one we saw before - hang in here and we will show you how it’s going to unfold.

In the next few paragraphs we are going to give you insight nobody is talking about, it is a fatal virus for Oracle and other tech companies built on the relational model.

Ellison’s bet, like the quantum bet, is software cannot be made to run faster - data centers need to be made bigger - and A.I. is the technology demanding huge data centers - running Oracle.

META is building a data center the size of Manhattan - so they all think the same way.

Every tech analyst is on board - they always are - that’s why when collapse comes, everyone is stunned - while a handful of guys make a killing.

The problem is software CAN be made to run 1,000 to a million times faster through the reduction of I/O wait states - which is about 95% of what software does.

If software can be made to run 1,000 times faster, it can do the same work with 1/1,000th the hardware.

Thus it needs only 1/1,000th the energy = NO DATA CENTER - or the current data center can do 1,000 times more work, thus no need for Larry Ellison’s half trillion dollars in NEW data centers.

Software speed is happening without Oracle - and if Oracle or RDBMS is anywhere in the formula - software remains slow, needs a data center, destroys Virginia farm land.

That’s the emerging industry choice: Does the market want software that runs 1,000 times faster, uses less energy and is 1/10th the cost, reduces storage 90% and is almost infinitely scalable?

OR:

Does the market want massive data centers, Oracle license costs, slow software, energy constraints, software that chokes on massive databases…..

You can see where this is going.

And we haven’t added in those two new Hoover Dam projects the article above said were needed!

Blinding software speed - essential for A.I. modeling - via I/O wait state optimization is Kryptonite for Oracle and all RDBMS.

Same for the cloud.

These two tech alternatives - low I/O wait state software and current relational database-dependent applications - cannot coexist over the long term.

Once you eliminate the need for a relational database and the need for ever growing data centers, the Oracle story collapses.

That’s still not the fatal virus.

Oracle knows very well its database customers have nowhere else to go.

A massive application running on Oracle today will run on Oracle almost forever - the costs of change are prohibitive.

That is why currently every major agency and corporation spends over 60% of IT budgets on maintaining the stuff they have - not innovating - because they cannot get out of their infrastructure limitation.

But, low I/O wait state category software is proving to have a disruptive impact on application modernization - without Oracle.

ANY Oracle application can be re-platformed, in 90 days or less, to an I/O optimization technology, and will run 1,000 times faster, at 10% of the Oracle cost, reducing storage 90%, eliminating the need for a data center.

90 days means any company can build a risk free Digital Twin system - run the data through the Oracle legacy copy and the low I/O wait state copy - test every transaction - and dump Oracle or the RDBMS when they are comfortable it is safe to do so.

Those billions of dollars in savings become the Trust Fund to invest in A.I.

Every CIO is being asked today - how are you going to deliver A.I.?

When they learn they can capture and remove Oracle or RDBMS waste in their budget - move those applications seamlessly - risk free - to low I/O wait state software and put those saved dollars into A.I. - what do you think will happen?

Those are the little breadcrumbs of disruption you will not hear about anywhere but here - because we are the guys doing it.

Let’s go back to 1983.

This is how it’s going to happen - beginning in the next 18 months - so pay attention here.

The Great Oracle Tulip Bulb Crash is coming - engineered by competitors - like we did to Cullinet.

It’s hard to envision a company called Cullinet, which nobody under 50 ever heard of, owned the database world in 1983 - but they did.

They were a Wall Street darling.

Their CEO was on the front page of Business Week and spoke at many major tech conferences.

Every senior IT exec knew Cullinet meant success, and they lined up to buy Cullinet.

A company called ADR had an early relational-like database called Datacom. They lost to Cullinet in every engagement. 100% of the time. They were big deals too - as in $500,000 to a million bucks license fee - in the 80s.

But, unknown to the investment world, unseen by analysts, a slight but significant shift occurred in the market.

Tech talent became the hidden constraint.

Always look for those pesky emerging constraints - they become the seeds of disruption.

It is deep underlying market changes, invisible to the tech press, that cause companies with almost 100% market share - worth billions of dollars, to slowly become challenged, then to see their valuation collapse.

The current two constraints are energy and software speed.

Both are fatal to Oracle and every RDBMS vendor.

In the 80s, there were few DBAs (data base admins) - each was super expensive - at a time when salaries were climbing.

Cullinet and ADR went head to head, in Upstate NY, in Binghamton - for Singer Aerospace. Cullinet was set to win.

The ADR team innovated.

They interviewed a half dozen Cullinet customers. What did you like? How was the support? Are you the popular guy because you use Cullinet?

Everything came back roses.

Except, one thing kept sticking out.

“We love Cullinet. Everyone buys Cullinet, but, well since you ask, it’s really hard to change anything in IDMS - it does not adapt to our changing business.”

That was the opening. Then came the killer phrase.

“We use Cullinet, the problem is hiring a Cullinet DBA costs a ton, then we train them and they leave for more money.”

Back at Singer Aerospace…..

The ADR team set up a challenge - build a simple application in Cullinet and in Datacom. You, the Singer guys do it with our tech rep - do the same thing with Cullinet.

Then change the application - and experience how hard it is.

Cullinet collapsed.

The customer learned fast, the Cullinet story was old embedded pointer crap technology they could not easily modify, their DBA would cost a mint, and the ADR Datacom product could be adapted almost immediately.

Cullinet was all hype, all marketing, no cattle - because constraints changed and there was now an ALTERNATIVE.

Alternatives deliver obsolescence to market leaders.

After the ADR Singer win, which was huge, every deal went ADR.

It didn’t matter, the Wall Street analysts did not care about ADR, they cared about Cullinet. A tree had fallen in the forest and nobody heard it.

The ADR team contacted one of the 4 top Wall Street Cullinet analysts - his first name was Scott - and invited him to talk to customer after customer - who chose ADR Datacom over Cullinet - each told the same story.

The story was: “Everyone told us to buy Cullinet, but our business changes every day and Cullinet cannot change with it.”

Sound familiar?

Scott started publishing this material - from real sources, and the bullshit story collapsed - Cullinet’s valuation with it - and Cullinet was sold for scrap to Computer Associates. ADR died a few years later, as the tech world changed again.

So here we are - you the reader, you the hedge fund guy, you the technologist - you are hearing that low I/O wait state software is replacing Oracle or RDBMS in some deals - and in every one, guys like the Fractal guys - prove there is no need for Oracle, Palantir or any of these central processing dinosaurs.

The tech press ignores it - thus the opportunity.

Early customers are accumulating and partners are joining because they see a world-changing category emerging - low I/O wait state software that runs 1,000 to a million times faster than Oracle at 1/10th the cost, on current hardware - applications converted in a quarter.

There’s another little story you do not hear - most Oracle customers loathe that company. For several years, as our team met with CIOs and CFOs, their first question was “…..can you help me get rid of Oracle?”

Oracle has captive customers, not loyal ones - and an alternative - one that solves their energy needs, can implement A.I. immediately - without a new data center - at 10% of the cost is pretty appealing.

This week Oracle missed its earnings - but Ellison became $110 billion richer - because of a great story. Wall Street analysts are the most tech uneducated lot and they follow the herd - off the cliff.

You, the reader, however are reading about the ultimate constraint - not enough electric energy to run A.I. and you may sit through a Fractal briefing - with a Fractal user - and witness how a customer took a massive Oracle or other RDBMS billing system, on a mainframe, that needs 90 hours to produce a million bills - and Fractal ran it on a $6,000 computer and it did the same work in 10 minutes!

Oracle 92 hours - mainframe - Fractal 10 minutes, $6,000 computer - NO DATA CENTER - the energy of a kitchen microwave oven.

This is happening more frequently now and we are cataloguing it here.

Oracle is CAUSING the data center A.I. energy crisis - Fractal and the emerging low I/O wait state software category players are alleviating that crisis.

There could not be a more down the center of the plate comparison.

Four months ago, our team received a call from an attorney with whom we work - he was in DC at an event with a lot of high level government attorneys.

He said agency after agency was miffed their Oracle database was choking on volume, the Oracle reps didn’t much care, and they wished for an alternative.

Only a month later, our team was brought into a major cabinet level agency - to show low I/O wait state outcomes to a number of government types who need quantum speed software, now on current hardware.

Ellison is a brilliant marketer.

He knows it’s over for Oracle in the current market - so he is reinventing Oracle as a cloud vendor, and as an A.I. player.

Oracle is now in the distraction business.

Who knows, they may even buy Tik Tok - but their core business is obsolete and cloud computing cannot support their current valuation.

Ellison’s bet, like the quantum bet is current software cannot be made to run 1,000 times faster. Thus, bigger data centers are the answer, Larry can get them built, and they need Oracle.

Ellison’s bet is his captive customers have nowhere else to go - the costs of transition are too high.

Now, as Fractal proves, any Oracle application, of any size, any complexity, can be re-platformed on low I/O wait state systems in a single quarter - cutting costs 90% and increasing speed a thousand fold.

Fractal demonstrates - software can be made to run 1,000 to a million times faster - no data center needed, and Oracle slows software down.

Ellison and Oracle cannot benefit from low I/O wait state advancements - because those advancements operate WITHOUT relational databases.

Let’s say that again - even Fractal cannot make an Oracle relational database operate faster - because it’s obsolete.

You make software 1,000 times faster by eliminating Oracle and RDBMS.

Oracle’s fatal constraint is the Oracle database - 1980s technology which cannot handle 2025 required speed and needs energy we will not have for a generation.

These are the breadcrumbs of disruption and ultimate collapse.

It happened for Wang - overnight collapse after slow rot for 3 years.

It happened for DEC, Compaq, Cullinet, Kodak, and a dozen other market leaders - in each case, shocking the analysts.

In every case, those in the field, in the foxhole with the customer - saw it begin 18 months before the industry analysts.

You are in for a treat, because as we move more of these Oracle and RDBMS applications to low I/O wait state computing - Fractal - we are publishing the case histories - so you can decide if you want to educate yourself about short selling and put options.

And, for sure, we will be walking around Wall Street showing a lot of analysts something they might just want to check out.

FractalComputing Substack is a newsletter about the journey of taking a massively disruptive technology to market. We envision a book about our journey so each post is a way to capture some fun events.

Subscribe at FractalComputing.Substack.com

Fractal Website: Fractal-Computing.com

Fractal Utility Site: TheFractalUtility.com

Fractal Government Site: TheFractalGovernment.com

Fractal Sustainable Computing: TheSustainableComputinginitiative.com

@FractalCompute

Portions of our revenue are given to animal rescue charities.

Vaporware?!?!? lol Another secret word from the mysterious world of digital tech introduced to the everyday language of the common man. Rock'n roll